March 27, 2025

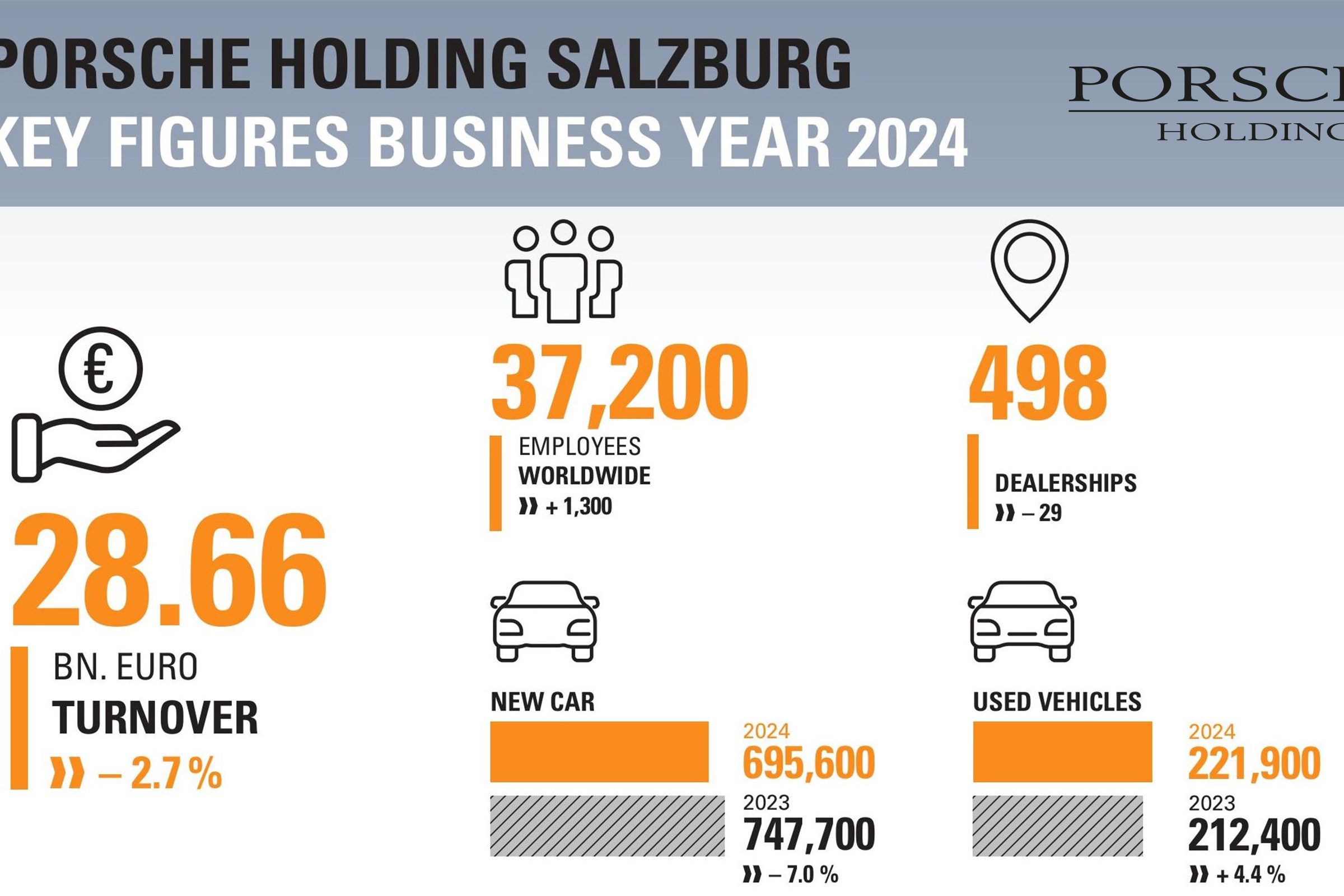

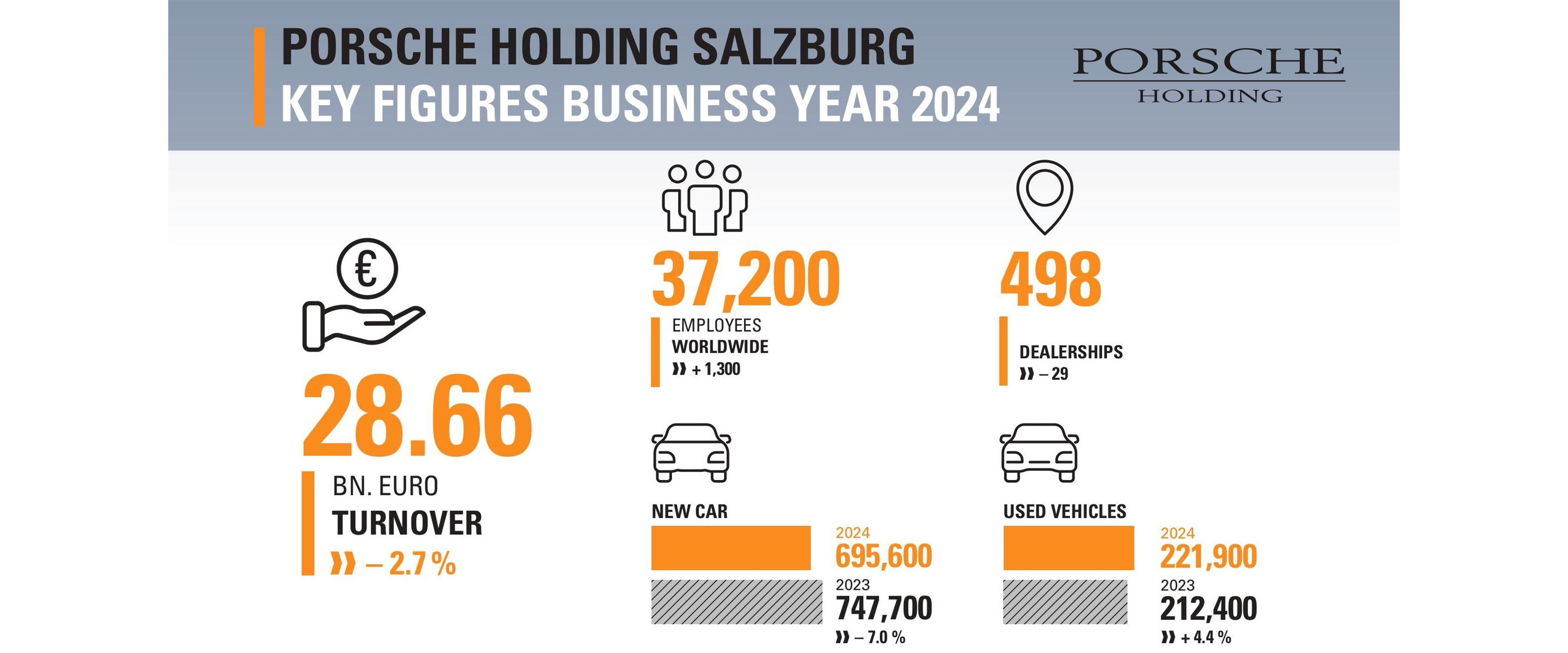

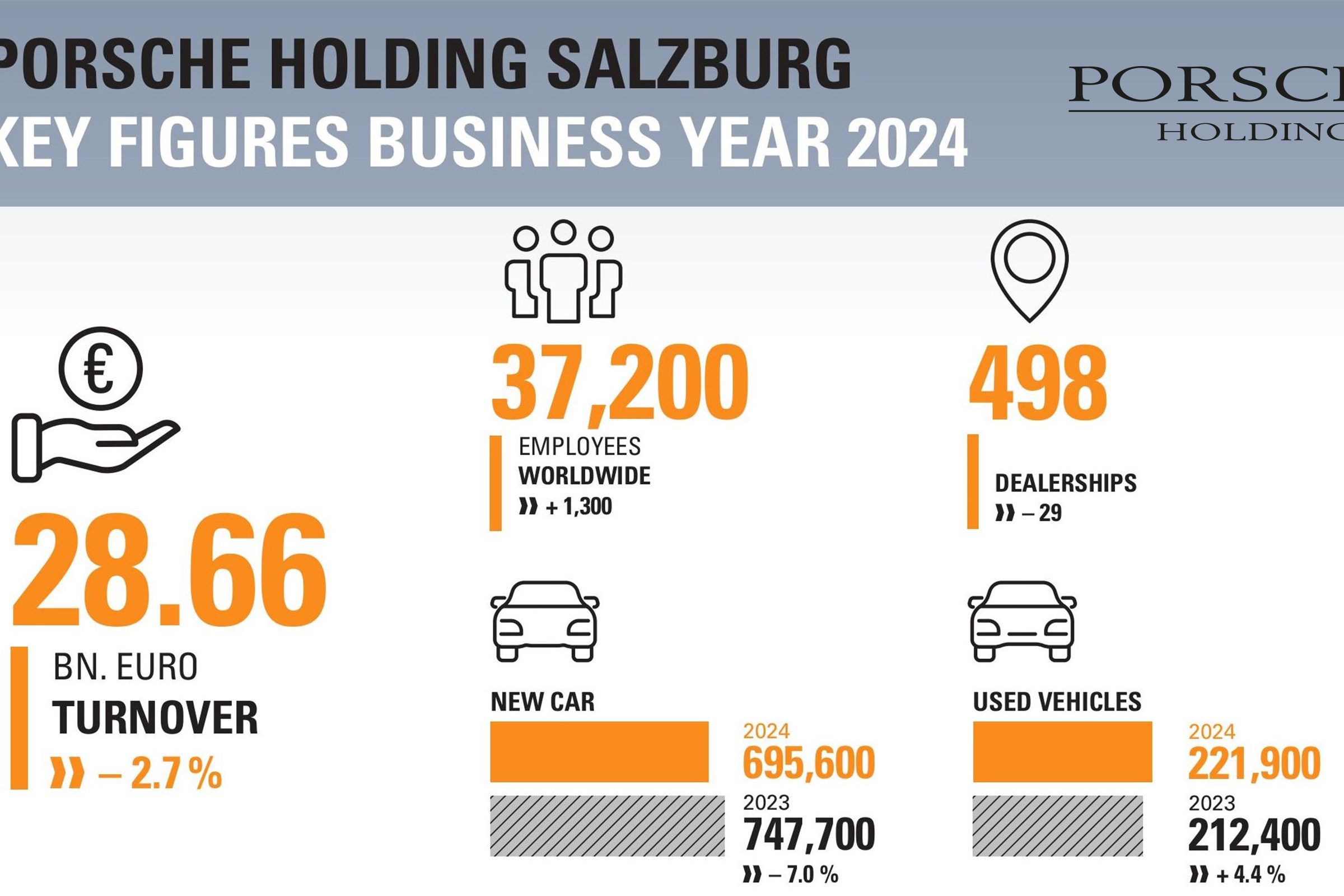

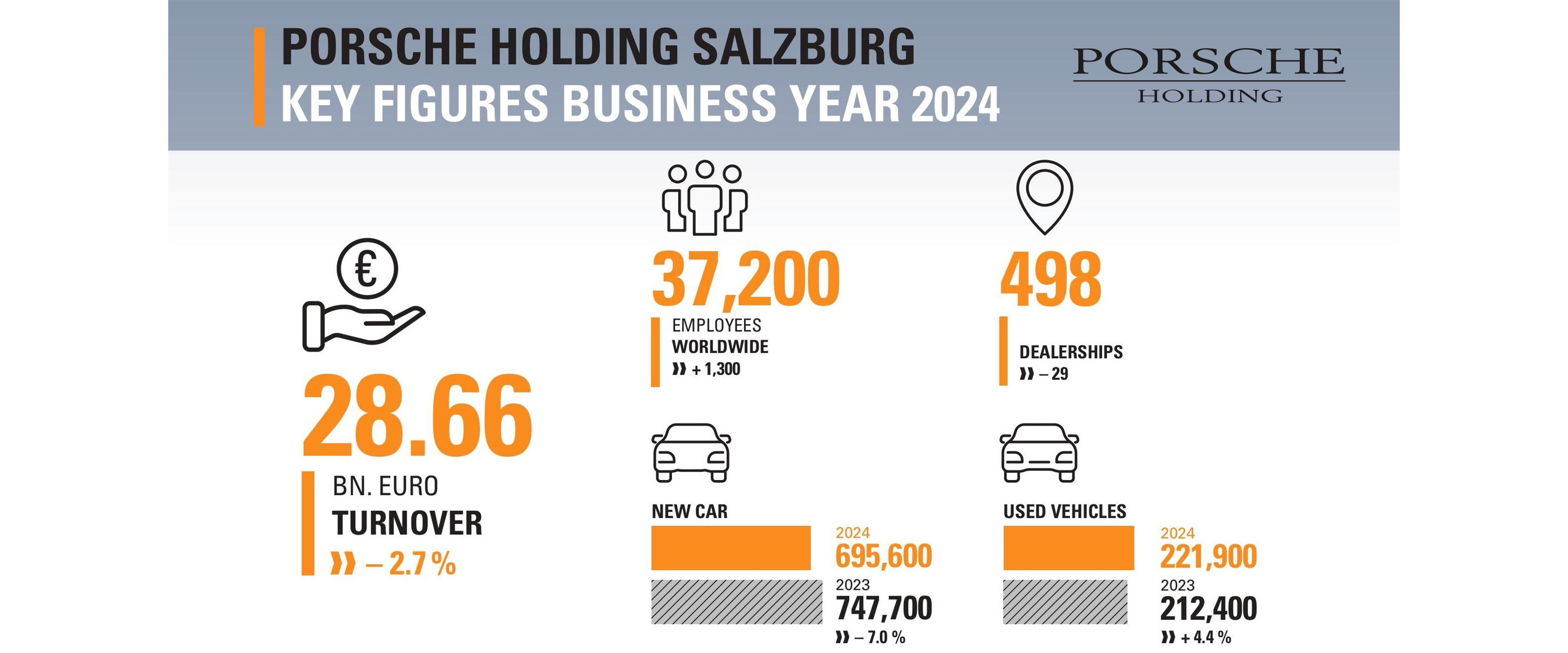

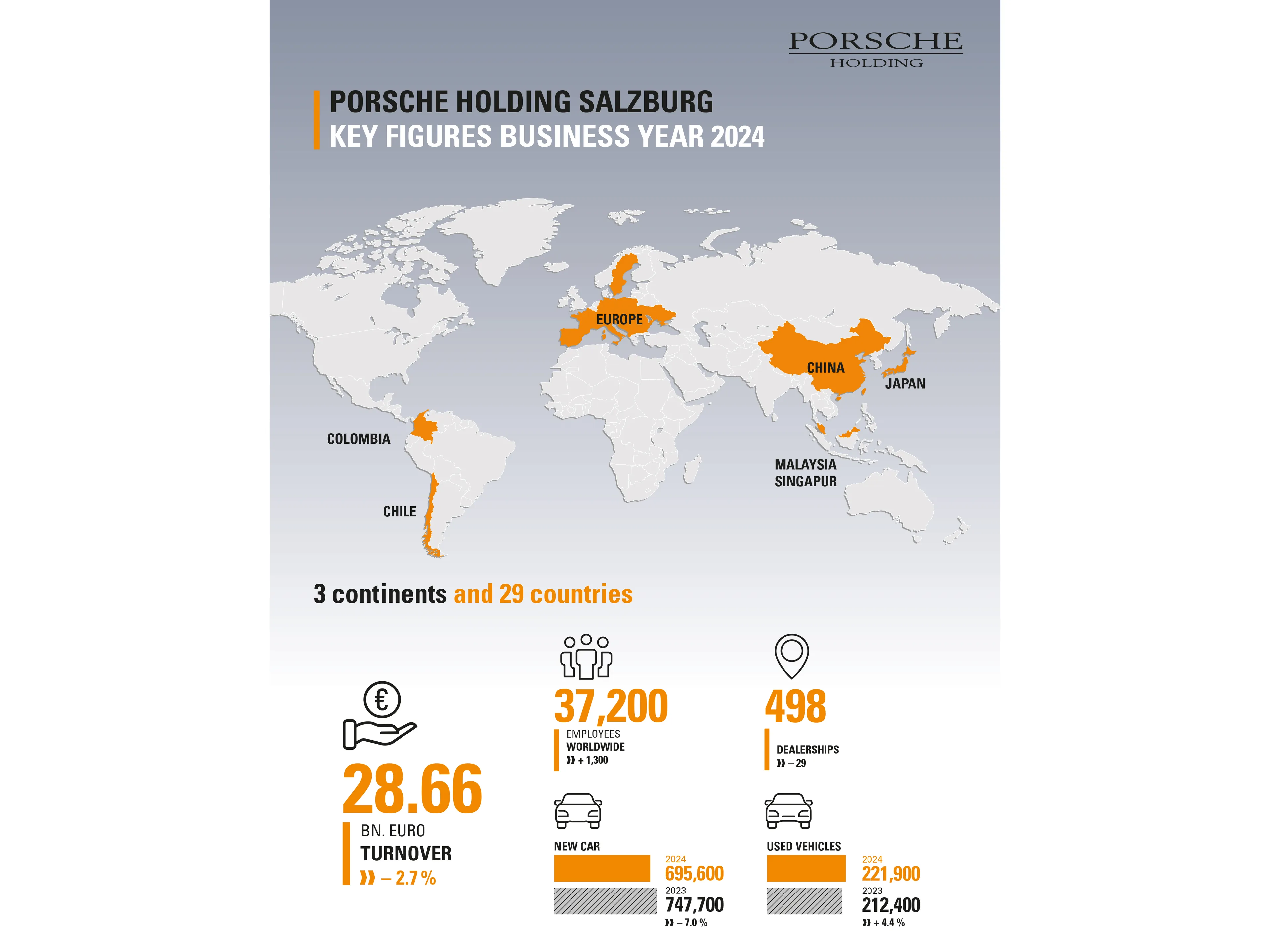

Porsche Holding Salzburg (PHS) was once again able to prove its capacity to deliver, in a year marked by political, economic and social challenges. The automotive distribution company, based in Salzburg and active in 29 countries on three continents, was able to almost seamlessly repeat the achievements of 2023, the most successful financial year in the company’s history. Recording revenues of 28.66 billion euros in 2024 (2023: 29.4 billion euros), this was the company’s second-best result ever (-2.7%).

In wholesale and retail, Porsche Holding achieved total sales of 695,600 new cars. Although a decline of 7%, this was well in line with the five-year average. At the same time sales of used cars grew, rising by 4.4% to 221,900 vehicles. The number of global dealerships fell compared to the previous year to 498 (-29) as the result of consolidations. The number of employees rose to 37,200 (+3.5%) as a result of new acquisitions and consolidations in individual countries as well as in the IT sector.

“We have demonstrated solidity and strategic strength although the economic environment in 2024 was significantly impacted by regional crises and market fluctuations. Thanks to our robust business model and the excellent sales performance by our employees worldwide, we were able to record an excellent result yet again,” summed up a satisfied Dr Hans Peter Schützinger, CEO of the Porsche Holding Salzburg Management Board.

These positive results establish a strong foundation, which allows Porsche Holding Salzburg to navigate the challenges of an increasingly intensified period of transformation. As well as its clear strategic roadmap, another important success factor is that Porsche Holding Salzburg serves the entire value chain in the automotive trade – from wholesale and retail to the financial services offered by Porsche Bank and Porsche Informatik’s IT solutions.

“Networking across all business segments enables us to precisely meet customer needs in all our markets, and to react more flexibly to market fluctuations,” Dr Hans Peter Schützinger explains. “At the same time, we have done our homework over the past years, consistently optimising the cost structure to further strengthen our financial resilience. The focus on performance and efficiency has proved its worth, and provides momentum for the future.”

All in all, the international markets developed unevenly and despite strong sales in wholesale and retail, lower levels of new car sales paired with the market situation in the Chinese luxury segment have left their mark on Porsche Holding Salzburg.

In wholesale, at 11.32 billion euros, Porsche Holding Salzburg maintained revenue at almost the level of the previous year (-1.1%), while new car sales fell to 333,600, 2.6% lower than in 2023. Austria remains the largest wholesale market by revenue at 37%, ahead of the Czech Republic, Romania, Hungary and Portugal. The number of wholesale employees has risen to 3,900 (+0.7%).

In retail, the Salzburg-based automotive retail company was almost able to maintain the high level of 2023 despite the challenging competitive environment. At 19.98 billion euros, revenue was only 3.6% lower than in the previous year, while at 4.7 billion euros (-2.3%), Germany was the market generating the most revenue. In China, formerly a booming market, revenue fell for the second year in succession, to 2.8 billion euros (-17.2%). The third strongest retail market is Italy, where revenue grew by 2.1% to 2.12 billion euros. New car sales in retail fell by 10.9% to 351,850 vehicles in 2024; the number of employees rose by 3% to 30,600. In addition, 10,150 new cars (-2.5%) were handled in retail directly by the importer companies, for example in Chile, Singapore or in small CEE countries.

In the 2024 automotive year, Porsche Holding Salzburg recorded another milestone in the form of the transfer of management responsibility for the two wholesale markets Italy and Sweden, providing the basis for future growth. Italy is one of Europe’s five largest automotive markets, and Sweden is a pioneer in e-mobility and digitalization.

“Italy and Sweden are two strategic markets offering numerous development and growth opportunities. We are now active in these countries in both wholesale and retail, and with Porsche Informatik. We are delighted that the Volkswagen Group has placed this trust in us, while at the same time acknowledging that this sets the bar higher. We will grow in every segment, opening up new revenue dimensions,” says Dr Hans Peter Schützinger, outlining the path ahead.

In 2024 the Porsche Bank Group, with over 1,500 employees in 15 countries, succeeded in further extending its leading position as a mobility financial services provider, once again recording an excellent result of over 1.5 million contracts in stock. A total of 664,818 new contracts were concluded, marking an 11% increase over the previous year. It is also pleasing that, at 49%, almost every second Volkswagen Group vehicle delivered by Porsche Holding Salzburg was financed by the Porsche Bank Group.

Porsche Informatik is one of the largest software development companies in Austria today with over 1,000 employees and operates in five countries with eight locations (three of which in Austria). No fewer than 180 customised solutions for the automotive wholesale, retail and financial services sectors are now in daily use by millions of users in 35 countries. Around 30% of its services are provided for the Volkswagen Group.

The outlook for this automotive year reflects the current challenges faced by the industry, which is in the midst of a fundamental transformation to electrical and digital mobility. 2025 will see volatile market conditions and further intensifying global competition.

“We expect the current automotive year will face even stronger headwinds than in the previous year. However, we will continue to focus our efforts on enhancing our performance and optimising costs in all business segments. This will ensure that we remain competitive with our existing business model in an increasingly insecure world,” says Dr Hans Peter Schützinger, looking ahead. “In terms of our organisation, that means having to be more agile and efficient where necessary. At the same time, it also means being more realistic about the headcount and its natural fluctuation. But I can reassure you that there is currently no need to reduce employee levels – we remain a stable and attractive employer.”

In 2025 Porsche Holding Salzburg will focus on further strengthening its excellent position in the European market, and on continuing to drive profitable growth in the new Swedish and Italian markets. In China, Asia and South America, however, the necessary programme of consolidation will be cautiously continued. In parallel, particular attention will be paid to e-mobility and digitalization.

“Therefore we will remain flexible over the coming year and plan conservatively, as continued volatility in the global marketplace will not improve the opportunities for growth. Quite the opposite, we are already seeing some countries in recession, making investments more problematic. However, we are optimistic that we will once again be able to record solid results,” says Dr Hans Peter Schützinger.

The weak economy is facing the automotive industry with softening demand, especially for electric cars. That will make 2025 an important year, especially for e-mobility in Europe, if we are to successfully (re)gain speed and achieve the short and long-term carbon goals.

“The road map to the electric future will take longer than politicians originally assumed and cannot be enacted in a linear fashion. In the end it is the customer who chooses the drive type. That makes recalibration at political level and within the industry unavoidable. However, the growing selection of affordable BEVs and PHEVs will again accelerate the growth in e-mobility in the coming years,” adds Dr Hans Peter Schützinger.

Revenue: 28.66 billion euros (-2.7%)

New cars: 695,600 (-7.0%)

Used cars: 221,900 (+4.4%)

Dealerships: 498 (-29)

Employees: 37,200 (+3.5%)

As the largest automobile dealer in Europe, Porsche Holding is always on the lookout for the best suppliers.

Louise-Piëch-Straße 2 5020 Salzburg / Austria Tel. +43/662/4681-0

© Porsche Holding Gesellschaft m.b.H, 2025

Louise-Piëch-Straße 2 5020 Salzburg / Austria Tel. +43/662/4681-0

As the largest automobile dealer in Europe, Porsche Holding is always on the lookout for the best suppliers.

© Porsche Holding Gesellschaft m.b.H, 2025

Louise-Piëch-Straße 2 5020 Salzburg / Austria Tel. +43/662/4681-0

As the largest automobile dealer in Europe, Porsche Holding is always on the lookout for the best suppliers.

© Porsche Holding Gesellschaft m.b.H, 2025